The Latham IPO Guide is a comprehensive resource designed to help companies navigate the complexities of going public, offering insights into legal, financial, and strategic considerations.

1.1 Overview of the Guide’s Purpose and Scope

The Latham IPO Guide serves as a detailed roadmap for companies contemplating an initial public offering (IPO), providing a thorough understanding of the process, risks, and opportunities. Its purpose is to equip businesses with the knowledge needed to make informed decisions about going public. The guide covers key aspects such as market conditions, financial readiness, legal requirements, and investor expectations. It also explores strategic considerations, including valuation, marketing, and post-IPO compliance. By addressing both the technical and strategic elements of an IPO, the guide aims to help companies navigate the complexities of entering the public markets with confidence and preparedness.

1.2 Importance of the Guide for Companies Considering an IPO

The Latham IPO Guide is an indispensable resource for companies exploring the possibility of going public. It provides critical insights into the complexities of the IPO process, enabling businesses to make informed decisions. By leveraging the guide, companies can better understand market dynamics, assess their readiness, and align their strategies with investor expectations. The guide also offers practical advice on navigating legal and regulatory challenges, ensuring compliance, and maximizing the potential for a successful IPO. For companies aiming to transition to public ownership, the guide serves as a trusted roadmap, helping them avoid common pitfalls and achieve their strategic objectives effectively.

Determining IPO Readiness

Evaluating market conditions, financial stability, and operational strength is crucial to assess a company’s readiness for an IPO, ensuring alignment with investor expectations and market demands.

2.1 Evaluating Market Conditions for an IPO

Evaluating market conditions involves analyzing economic trends, industry performance, and investor sentiment to determine if the climate is favorable for a successful IPO. A stable or growing market typically indicates positive investor appetite, while volatile conditions may pose risks. Companies should assess the performance of similar firms that have recently gone public to gauge potential reception. Additionally, understanding the broader economic environment, such as interest rates and geopolitical factors, is essential. The Latham IPO Guide emphasizes the importance of timing, ensuring that the IPO aligns with a receptive market to maximize valuation and investor interest.

2.2 Assessing the Company’s Financial and Operational Readiness

Assessing a company’s financial and operational readiness is crucial for a successful IPO. This involves reviewing financial statements for accuracy and consistency, ensuring compliance with accounting standards, and demonstrating a clear growth trajectory. Operational readiness includes evaluating management systems, internal controls, and infrastructure to support public company demands. The Latham IPO Guide highlights the need for robust financial planning, transparent reporting, and a solid governance framework to meet investor and regulatory expectations. Companies must also address any financial vulnerabilities and ensure scalability to sustain growth post-IPO. This thorough assessment ensures the company is prepared for the rigors of being publicly traded.

2.3 Understanding Investor Perspectives and Expectations

Understanding investor perspectives and expectations is vital for a successful IPO. Investors seek companies with strong growth potential, clear business models, and transparent financial reporting. They also evaluate management credibility, industry trends, and competitive positioning. The Latham IPO Guide emphasizes aligning the company’s narrative with investor priorities, such as long-term value creation and risk management. Companies must articulate a compelling equity story, addressing key concerns like scalability, profitability, and market differentiation. By understanding these expectations, companies can tailor their IPO strategy to attract institutional and retail investors, ensuring a positive market reception and maximizing valuation. This alignment is critical for building investor confidence.

Pre-IPO Preparations

Pre-IPO preparations involve strengthening financial statements, ensuring legal compliance, and optimizing corporate governance. This phase also includes audits, management team reinforcement, and strategic planning to enhance investor confidence.

3.1 Financial Statement Preparation and Audits

Accurate financial statements are critical for an IPO. Companies must prepare audited financials adhering to GAAP or IFRS, ensuring transparency and compliance. This involves detailed reviews of income statements, balance sheets, and cash flow reports. Audits verify the accuracy of these documents, building investor trust. Proper documentation of revenue recognition, expenses, and liabilities is essential. Additionally, historical financial data must be presented clearly, highlighting trends and financial health. This step ensures that investors and regulators have a clear understanding of the company’s fiscal standing, which is vital for a successful IPO and maintaining compliance post-listing.

3.2 Legal and Corporate Governance Structures

Establishing robust legal and corporate governance structures is essential for a successful IPO. Companies must ensure compliance with SEC regulations, including proper disclosure practices and transparent financial reporting. A strong board of directors, with independent members, is critical to oversee governance and ensure accountability. Legal frameworks must be in place to protect shareholder rights and maintain ethical business practices. Additionally, companies should review and update their bylaws, Articles of Association, and other governance documents to align with public company standards. This ensures regulatory compliance, builds investor confidence, and supports long-term sustainability. Proper governance structures are vital for navigating the complexities of going public.

3.3 Building a Strong Management Team

Building a strong management team is critical for a successful IPO. A cohesive and experienced leadership group instills investor confidence and demonstrates the company’s ability to execute its strategy. Key qualities include proven leadership, deep industry expertise, and a track record of driving growth. The team should be diverse, bringing varied perspectives to decision-making. Effective communication and transparency are essential, as investors seek clarity on the company’s vision and operations. Additionally, the management team must be prepared to adapt to public company expectations, including increased scrutiny and accountability. A well-rounded and skilled leadership team is vital for navigating the IPO process and achieving long-term success.

The IPO Process

The IPO process involves selecting underwriters, drafting the prospectus, and conducting roadshows to attract investors. It requires collaboration with advisors to ensure regulatory compliance and successful execution.

4.1 Selecting Underwriters and Advisors

Selecting the right underwriters and advisors is crucial for a successful IPO. Underwriters play a key role in pricing and distributing shares, while legal and financial advisors ensure compliance and strategy alignment. Their expertise helps navigate regulatory requirements and market dynamics, making informed decisions on structuring the IPO. A strong team enhances credibility and investor confidence, ultimately contributing to a smooth and effective IPO process.

4.2 Drafting the Prospectus and Regulatory Filings

Drafting the prospectus and regulatory filings is a critical step in the IPO process. The prospectus serves as the primary disclosure document, providing investors with detailed information about the company’s financials, business operations, and risks. It must comply with SEC requirements, ensuring transparency and accuracy. Legal advisors play a key role in structuring the document to meet regulatory standards while effectively communicating the company’s value proposition. Additionally, companies must file registration statements with the SEC, which undergo rigorous review. Accurate and compliant filings are essential to avoid delays and ensure a smooth IPO process, building investor confidence and meeting legal obligations.

4.4 Roadshows and Investor Marketing

Roadshows and investor marketing are pivotal in generating interest and excitement for an IPO. These events allow management teams to present the company’s story, vision, and growth potential to institutional investors and analysts. Effective marketing strategies, including presentations, videos, and digital content, help differentiate the company from competitors. The roadshow typically includes a series of meetings and presentations in key financial hubs, enabling direct engagement with potential investors. This phase is crucial for building credibility, addressing investor concerns, and securing commitments, ultimately influencing the IPO’s success and valuation. A well-executed roadshow can significantly enhance investor confidence and demand for the offering.

Legal and Regulatory Considerations

Understanding SEC compliance, disclosure requirements, and regulatory laws is critical for a smooth IPO process, ensuring transparency and adherence to legal standards for public offerings.

5.1 SEC Registration and Compliance Requirements

SEC registration is a cornerstone of the IPO process, requiring companies to file a registration statement with detailed financial and operational disclosures. This includes audited financial statements, management discussions, and risk factors. The SEC reviews these documents to ensure compliance with federal securities laws, protecting investors and maintaining market integrity. Companies must also adhere to ongoing reporting obligations post-IPO, such as quarterly and annual filings. Understanding these requirements is essential for navigating the regulatory landscape successfully and avoiding potential legal or financial repercussions. Proper compliance ensures transparency and builds investor confidence, which are critical for a successful public offering.

5.2 Disclosure Requirements and Risk Factors

Companies undergoing an IPO must disclose comprehensive information in their SEC filings, including financial statements, management discussions, and analysis (MD&A), and detailed risk factors. These disclosures ensure transparency and provide investors with a clear understanding of the company’s operations, challenges, and potential threats. Risk factors should be specific and relevant, addressing internal and external risks such as market conditions, regulatory changes, or operational vulnerabilities. Additionally, companies must disclose forward-looking statements, which are protected under safe harbor provisions if based on reasonable assumptions. Compliance with these disclosure requirements is critical to building investor confidence and meeting SEC regulations, ultimately supporting a successful IPO process.

5.3 Understanding IPO-related Laws and Regulations

Understanding IPO-related laws and regulations is crucial for ensuring compliance and avoiding legal pitfalls. The SEC oversees IPOs, requiring companies to register securities and provide detailed disclosures. Key regulations include the Securities Act of 1933 and the Sarbanes-Oxley Act. Companies must also comply with stock exchange listing standards. International issuers may need to navigate additional rules, such as Regulation S or Rule 144A. Legal frameworks govern areas like insider trading, corporate governance, and auditor independence. Compliance with these laws ensures transparency, protects investors, and maintains market integrity. Latham’s IPO Guide provides detailed insights into these regulations, helping companies navigate the complex legal landscape effectively.

Financial Considerations

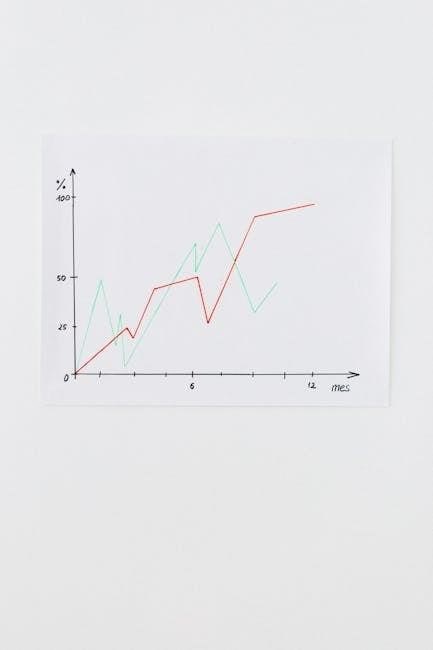

Valuation strategies, cost structures, and risk management are critical financial aspects of an IPO. Companies must balance pricing strategies with market conditions to optimize outcomes and minimize risks.

6.1 Valuation and Pricing Strategies

Valuation and pricing strategies are pivotal in an IPO, impacting market reception and investor confidence. Companies must assess market demand, financial performance, and industry benchmarks to determine optimal pricing. The guide emphasizes balancing competitive pricing with realistic valuations to attract investors while ensuring sustainable post-IPO growth. Understanding investor expectations and market conditions is crucial for setting a price range that aligns with company goals. Effective valuation strategies also involve considering equity research analyst feedback and underwriter insights to refine pricing models. This ensures the IPO strikes the right balance between raising capital and maintaining shareholder value, ultimately driving long-term success;

6.2 Cost Structures and Budgeting for the IPO

Understanding the cost structures and budgeting for an IPO is essential for effective financial planning. The Latham IPO Guide outlines the various expenses, including underwriter fees, legal costs, and regulatory filings. Companies must allocate resources wisely, balancing upfront investments with long-term benefits. Proper budgeting ensures transparency and accountability, helping stakeholders understand the financial commitments involved. The guide also highlights the importance of contingency planning to address unforeseen costs, ensuring the IPO process remains on track without compromising financial stability. By managing costs strategically, companies can optimize their IPO outcomes and set a solid foundation for future growth and profitability.

6.3 Managing Financial Risks Associated with Going Public

Going public introduces unique financial risks that require meticulous management. The Latham IPO Guide emphasizes the importance of identifying and mitigating these risks to ensure a smooth transition. Market volatility, regulatory changes, and investor expectations can impact valuation and stability. Companies must implement robust financial controls and disclosures to maintain transparency. Additionally, understanding liability risks and ensuring adequate insurance coverage is crucial. The guide provides strategies for assessing and addressing potential risks, helping companies navigate the complexities of becoming publicly traded. Effective risk management not only protects the company’s financial health but also builds investor confidence, which is vital for long-term success.

Marketing and Investor Engagement

Effective marketing and investor engagement are critical for a successful IPO. The guide outlines strategies for crafting a compelling narrative, leveraging digital channels, and building strong investor relationships.

7.1 Developing an Effective IPO Marketing Strategy

Developing an effective IPO marketing strategy involves refining your message, identifying your target audience, and leveraging digital channels to maximize visibility. Just as a well-crafted search query yields precise results, a tailored marketing strategy ensures your IPO resonates with potential investors. By understanding your audience’s priorities and expectations, you can craft a compelling narrative that highlights your company’s strengths and growth potential. This approach mirrors the precision of Boolean logic in search queries, where balancing broad and specific terms yields optimal outcomes. A strong strategy also incorporates media relations and investor roadshows, ensuring consistent communication and building credibility, much like how advanced search techniques refine results. Ultimately, a well-executed marketing strategy is key to attracting investor interest and achieving a successful IPO.

7.2 Engaging with Institutional and Retail Investors

Engaging both institutional and retail investors is crucial for a successful IPO. Institutional investors, such as QIBs, require detailed financial data and long-term growth potential, while retail investors may focus on brand recognition and market potential. Tailoring your messaging to these distinct audiences ensures broader appeal. For institutional investors, emphasize financial stability, governance, and market leadership. For retail investors, highlight relatable narratives and accessible growth opportunities. Utilize roadshows, digital platforms, and transparent communication to build trust and interest. Balancing broad and specific messaging, akin to refining search queries, ensures your pitch resonates effectively with both groups, maximizing investor participation and enthusiasm. Consistent engagement post-IPO further strengthens these relationships.

7.3 Role of Media and Public Relations in the IPO Process

Media and public relations play a pivotal role in shaping investor perception and building credibility during an IPO. Strategic communication helps craft a compelling narrative, highlighting the company’s strengths and growth potential. Targeted messaging ensures consistent delivery across platforms, aligning with investor expectations. Media outreach amplifies visibility, reaching both institutional and retail investors, while managing reputation and addressing concerns proactively mitigates risks. Effective PR fosters trust and transparency, essential for a successful IPO and long-term investor relations. By leveraging media strategically, companies can enhance their market position and attract diverse investor interest, ultimately supporting a favorable market debut and sustained growth.

Debut and Post-IPO Considerations

Ensuring a smooth market debut and managing post-IPO obligations, including reporting requirements and investor relations, are critical for maintaining credibility and long-term success as a public company.

8.1 The First Day of Trading and Market Debut

The first day of trading marks a pivotal moment for companies, as they transition from private to public entities. This debut involves setting the opening price, managing initial trading activity, and ensuring market stability. The IPO team, including underwriters and advisors, plays a crucial role in guiding the process. Companies must be prepared for heightened media attention and investor scrutiny. A successful market debut not only reflects the company’s readiness but also sets the tone for its future performance and investor confidence. Proper planning and execution are essential to navigate this milestone effectively and achieve a positive market reception.

8.2 Post-IPO Reporting Requirements and Compliance

Following the IPO, companies must adhere to stringent reporting requirements and regulatory compliance. This includes filing periodic reports such as 10-K, 10-Q, and 8-K forms with the SEC, providing detailed financial and operational updates. Public companies are also subject to SOX (Sarbanes-Oxley Act) compliance, ensuring internal controls over financial reporting. Additionally, ongoing disclosure obligations require transparency on material events, risks, and governance practices. Compliance with these requirements is critical to maintaining investor trust, avoiding regulatory penalties, and ensuring the company operates in accordance with legal and ethical standards. Proactive management of these obligations is essential for long-term success as a publicly traded entity.

8.3 Managing Investor Relations Post-IPO

Effective investor relations (IR) management post-IPO is crucial for maintaining a positive market perception and fostering trust with stakeholders. This involves regular communication through earnings calls, investor presentations, and annual reports. Companies should establish a dedicated IR function to engage with institutional and retail investors, addressing their queries and concerns. Consistent and transparent messaging ensures alignment with investor expectations. Additionally, leveraging media and public relations can amplify the company’s story, enhancing its visibility and credibility. By maintaining open dialogue and demonstrating strategic clarity, companies can build long-term investor confidence, which is vital for sustained growth and stability in the public markets.